Top Guidelines Of Fortitude Financial Group

Top Guidelines Of Fortitude Financial Group

Blog Article

Fortitude Financial Group Fundamentals Explained

Table of ContentsGetting My Fortitude Financial Group To WorkThings about Fortitude Financial GroupWhat Does Fortitude Financial Group Mean?The Buzz on Fortitude Financial Group

With the best strategy in position, your money can go better to assist the companies whose missions are lined up with your worths. An economic advisor can help you specify your philanthropic offering goals and incorporate them into your monetary strategy. They can likewise encourage you in ideal methods to maximize your providing and tax reductions.If your company is a partnership, you will certainly intend to go via the sequence planning process with each other - Financial Resources in St. Petersburg. A monetary advisor can assist you and your companions understand the crucial parts in company succession preparation, determine the value of the business, produce shareholder contracts, develop a compensation framework for successors, synopsis transition alternatives, and far more

The secret is finding the ideal monetary expert for your scenario; you might wind up interesting different advisors at different stages of your life. Try contacting your monetary organization for suggestions. Content is for informational purposes only and is not planned to supply lawful or monetary suggestions. The sights and viewpoints expressed do not always represent the sights and opinions of WesBanco.

Your next action is to consult with a certified, certified specialist who can provide advice customized to your individual scenarios. Absolutely nothing in this article, neither in any type of connected sources, need to be taken as monetary or lawful guidance. Additionally, while we have made good faith initiatives to ensure that the details presented was correct as of the date the web content was prepared, we are incapable to ensure that it remains exact today.

The Best Guide To Fortitude Financial Group

Financial consultants help you make decisions regarding what to do with your cash. Let's take a more detailed look at what specifically an economic consultant does.

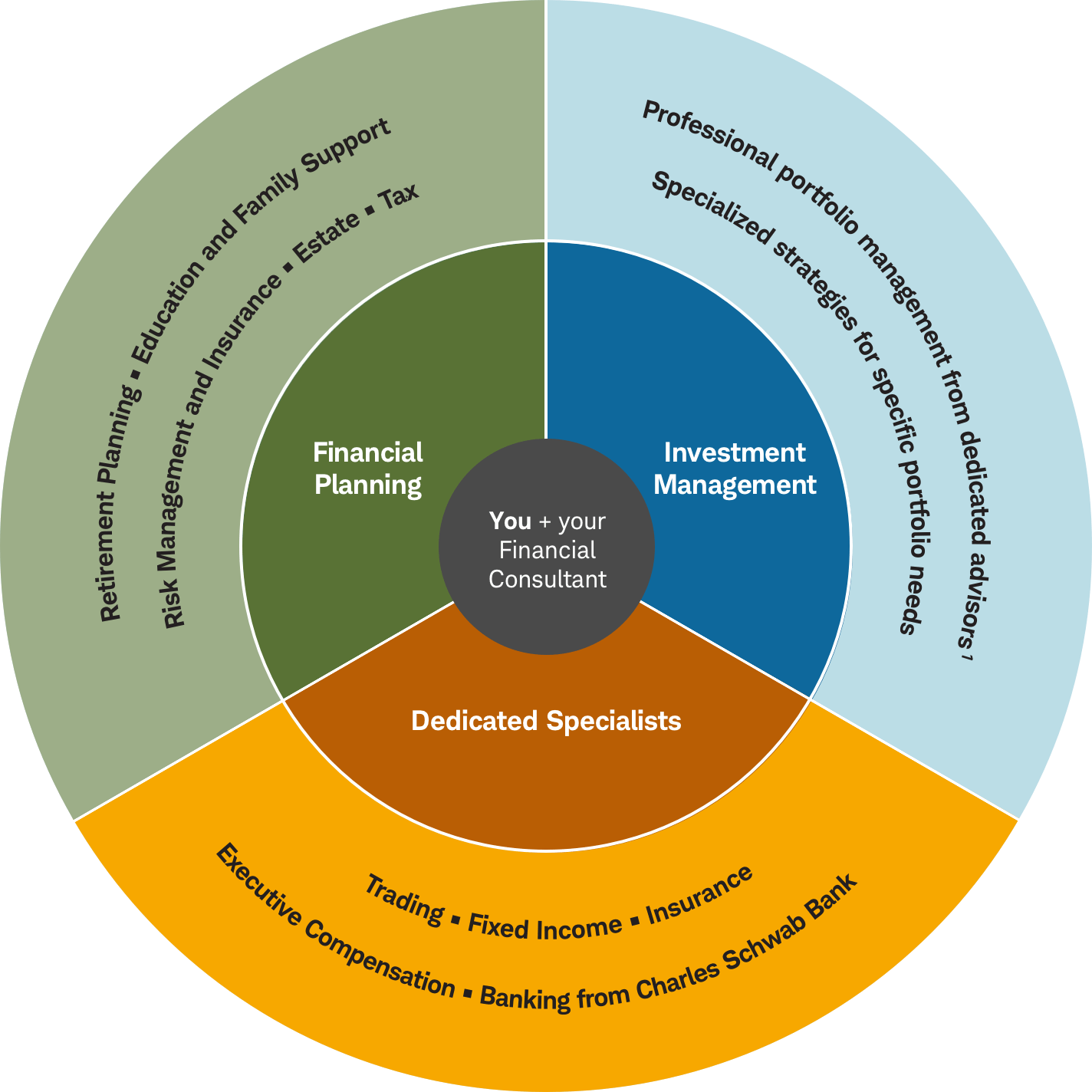

Advisors utilize their knowledge and proficiency to build tailored economic strategies that intend to achieve the economic goals of customers (https://www.storeboard.com/fortitudefinancialgroup1). These plans consist of not only investments but likewise financial savings, spending plan, insurance coverage, and tax obligation approaches. Advisors even more check in with their customers often to re-evaluate their present situation and plan appropriately

All about Fortitude Financial Group

To accomplish your objectives, you might need a knowledgeable professional with the ideal licenses to help make these plans a fact; this is where an economic consultant comes in. Together, you and your advisor will cover several subjects, consisting of the quantity of cash you ought to conserve, the types of accounts you need, the kinds of insurance policy you should have (including long-term care, term life, special needs, etc), and estate and tax planning.

Financial advisors give a range of solutions to clients, whether that's providing credible basic financial investment guidance or aiding in getting to a financial goal like buying a college education fund. Below, find a listing of one of the most common services offered by monetary advisors.: A financial expert provides suggestions on financial investments that fit your design, objectives, and risk resistance, establishing and adapting spending approach as needed.: A monetary advisor produces approaches to help you pay your debt and prevent debt in the future.: A financial advisor supplies suggestions and approaches to develop spending plans that aid you meet your goals in the short and the lengthy term.: Component of a budgeting approach might include approaches that help you pay for higher education.: Similarly, an economic advisor develops a conserving plan crafted to your details demands as you head into retirement. https://hearthis.at/fortitudefg-iq/set/fortitude-financial-group/.: An economic consultant helps you recognize individuals or organizations you wish to get your tradition after you pass away and produces a plan to execute your wishes.: A financial consultant supplies you with the very best long-term remedies and insurance coverage options that fit your budget.: When it involves taxes, a monetary advisor might aid you prepare income tax return, optimize tax deductions so you get the most out of the system, routine tax-loss harvesting protection sales, make certain the ideal use of the resources gains tax obligation rates, or plan to minimize taxes in retired life

On the survey, you will certainly also indicate future pensions and revenue sources, project retired life needs, and describe any type of long-lasting economic responsibilities. Simply put, you'll provide all existing and expected financial investments, pension plans, gifts, and sources of earnings. The investing part of the survey discuss more subjective topics, such as your danger resistance and risk capacity.

The Of Fortitude Financial Group

At this moment, you'll likewise allow your advisor understand your financial investment choices as well. The preliminary assessment may likewise include an evaluation of other economic monitoring subjects, such as insurance policy issues and your tax obligation situation. The consultant needs to be mindful of your present estate plan, as well as various other experts on your planning group, such as accountants and legal representatives.

Report this page